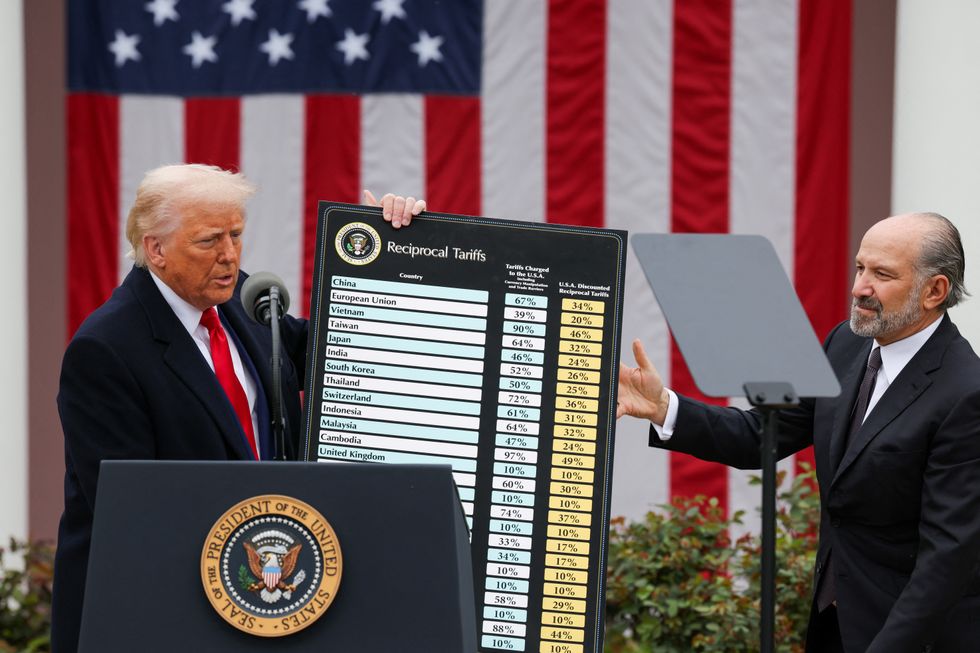

Pension crisis hits as Britons told 'push back retirement' as Donald Trump's tariff turmoil eats into savings

Recent market turbulence has caused concern among UK pension savers, with some being told to consider delaying their retirement.The value of many pension pots has dropped due to global instability, including the latest trade tariffs announced by President Donald Trump.Financial experts are urging people not to panic but to remain cautious and consider all options including postponing retirement or taking smaller withdrawals from their pension pots until markets stabilise.Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, warned that while it’s unsettling to see pension values fall, keeping a level head is key.She said: "Trump’s tariff turbulence has caused a lot of people to worry about their pensions. It’s never nice to see the value of your retirement savings go down and there can be real uncertainty as to when things will get any better. However, it’s important not to panic.“Pensions are a long-term game – your investment horizon could span 70 years – and it pays to take a long-term approach."The advice comes as millions of pension savers log into their accounts only to see their balances drop, even after years of diligent contributions. Those approaching retirement are among the most vulnerable, with limited time to recoup losses. But by "putting off retirement for a while," savers could recover any losses as history suggests that patience may be rewarded.For example the Covid pandemic, markets plunged by 31.7 per cent within just one month. A year later, they were still down by 7.2 per cent. However, fast forward three years and those same markets had not only recovered but gained 5.8 per cent above their pre-pandemic level.Morrisey said: "Those closer to retirement can potentially look at whether to put off retirement for a while, or else take less income than initially planned to give their investments time to recover."While there’s no crystal ball for what lies ahead, Morrisey states that making rash decisions such as stopping pension contributions or switching to lower-risk investments during a downturn – could do more harm than good.She also pointed to the importance of diversification explaining those invested in well-diverse funds over geographical locations and asset classes won't be fully exposed to stock market swings which can help even things out.She continued: "Making knee-jerk reactions such as switching investments or stopping contributions can cause damage to your portfolio and make it harder to recover when things do settle down."With consumer prices and global instability on the rise, the current landscape may feel bleak. However for most pension savers, the best strategy remains simple: stay invested, stay diversified, and stay patient.As always, those unsure of what to do next should consider seeking financial advice before making any major decisions.

Recent market turbulence has caused concern among UK pension savers, with some being told to consider delaying their retirement.

The value of many pension pots has dropped due to global instability, including the latest trade tariffs announced by President Donald Trump.

Financial experts are urging people not to panic but to remain cautious and consider all options including postponing retirement or taking smaller withdrawals from their pension pots until markets stabilise.

Helen Morrissey, head of retirement analysis at Hargreaves Lansdown, warned that while it’s unsettling to see pension values fall, keeping a level head is key.

She said: "Trump’s tariff turbulence has caused a lot of people to worry about their pensions. It’s never nice to see the value of your retirement savings go down and there can be real uncertainty as to when things will get any better. However, it’s important not to panic.

“Pensions are a long-term game – your investment horizon could span 70 years – and it pays to take a long-term approach."

The advice comes as millions of pension savers log into their accounts only to see their balances drop, even after years of diligent contributions.

Those approaching retirement are among the most vulnerable, with limited time to recoup losses. But by "putting off retirement for a while," savers could recover any losses as history suggests that patience may be rewarded.

For example the Covid pandemic, markets plunged by 31.7 per cent within just one month. A year later, they were still down by 7.2 per cent.

However, fast forward three years and those same markets had not only recovered but gained 5.8 per cent above their pre-pandemic level.

Morrisey said: "Those closer to retirement can potentially look at whether to put off retirement for a while, or else take less income than initially planned to give their investments time to recover."

While there’s no crystal ball for what lies ahead, Morrisey states that making rash decisions such as stopping pension contributions or switching to lower-risk investments during a downturn – could do more harm than good.

She also pointed to the importance of diversification explaining those invested in well-diverse funds over geographical locations and asset classes won't be fully exposed to stock market swings which can help even things out.

She continued: "Making knee-jerk reactions such as switching investments or stopping contributions can cause damage to your portfolio and make it harder to recover when things do settle down."

With consumer prices and global instability on the rise, the current landscape may feel bleak. However for most pension savers, the best strategy remains simple: stay invested, stay diversified, and stay patient.

As always, those unsure of what to do next should consider seeking financial advice before making any major decisions.