Skipton Building Society increases interest rate on two savings accounts - savers can get 5% cash ISA

Skipton Building Society has increased the interest rate on two savings accounts, including boosting the Bonus Cash ISA to a competitive rate of five per cent for the first 12 months.It means the building society now offers one of the highest-paying Cash ISAs on the savings market, according to Moneyfacts.Coventry Building Society‚Äôs Four Access ISA (Online) pays a 5.05 per cent AER, with four penalty-free withdrawals permitted per year.Chorley Building Society also offers a five per cent AER interest rate on its Access Cash ISA but savers can only make one withdrawal per calendar year or the rate will drop.Skipton Building Society‚Äôs Bonus Cash ISA, which was launched several weeks ago, offers savers easy access to their tax-free savings account.The Bonus Cash ISA offers an uplift of one per cent for the first year, bringing it to the competitive five per cent rate.Withdrawals are unlimited and savers can start saving from ¬£1.The account can be opened in branch, by phone, by post and online.As with any other cash ISA, savers can deposit up to ¬£20,000 each year ‚Äď provided they don‚Äôt breach the annual allowance ‚Äď and can transfer in their previous years‚Äô ISA savings.Skipton Building Society is also increasing the interest rate on its Single Access Saver to 5.15 per cent.The Single Access Saver is a variable savings account that allows one fee-free withdrawal each year.Maitham Mohsin, Head of Savings at Skipton Building Society, said: ‚ÄúAfter the Bank of England decided to hold its Base Rate last time out, it appears savings rates may have started to level off and in some product areas start to fall. LATEST DEVELOPMENTS:HSBC warns there's just one week left to get 5.7% savings account offerBest fixed cash ISAs: Top accounts for tax-free savings paying up to 5.85%Best easy access savings accounts right now offering up to 5.2%‚ÄúHere at Skipton, we‚Äôre trying to buck the trend and are taking the opportunity to increase a couple of our rates today.‚ÄúBoth of these accounts are fantastic options for savers looking to get their money working through the remainder of this year and into next, particularly if you‚Äôre not looking to totally lock your cash away for a fixed period of time.‚ÄĚSavers have been seeing a number of savings providers increase interest rates on savings recently, amid the Bank of England increasing the base rate 14 consecutive times.However, there's been speculation that fewer savings boosts will be seen after the Bank of England voted to hold the base rate at 5.25 per cent last month.

Skipton Building Society has increased the interest rate on two savings accounts, including boosting the Bonus Cash ISA to a competitive rate of five per cent for the first 12 months.

It means the building society now offers one of the highest-paying Cash ISAs on the savings market, according to Moneyfacts.

Coventry Building Society’s Four Access ISA (Online) pays a 5.05 per cent AER, with four penalty-free withdrawals permitted per year.

Chorley Building Society also offers a five per cent AER interest rate on its Access Cash ISA but savers can only make one withdrawal per calendar year or the rate will drop.

Skipton Building Society’s Bonus Cash ISA, which was launched several weeks ago, offers savers easy access to their tax-free savings account.

The Bonus Cash ISA offers an uplift of one per cent for the first year, bringing it to the competitive five per cent rate.

Withdrawals are unlimited and savers can start saving from £1.

The account can be opened in branch, by phone, by post and online.

As with any other cash ISA, savers can deposit up to ¬£20,000 each year ‚Äď provided they don‚Äôt breach the annual allowance ‚Äď and can transfer in their previous years‚Äô ISA savings.

Skipton Building Society is also increasing the interest rate on its Single Access Saver to 5.15 per cent.

The Single Access Saver is a variable savings account that allows one fee-free withdrawal each year.

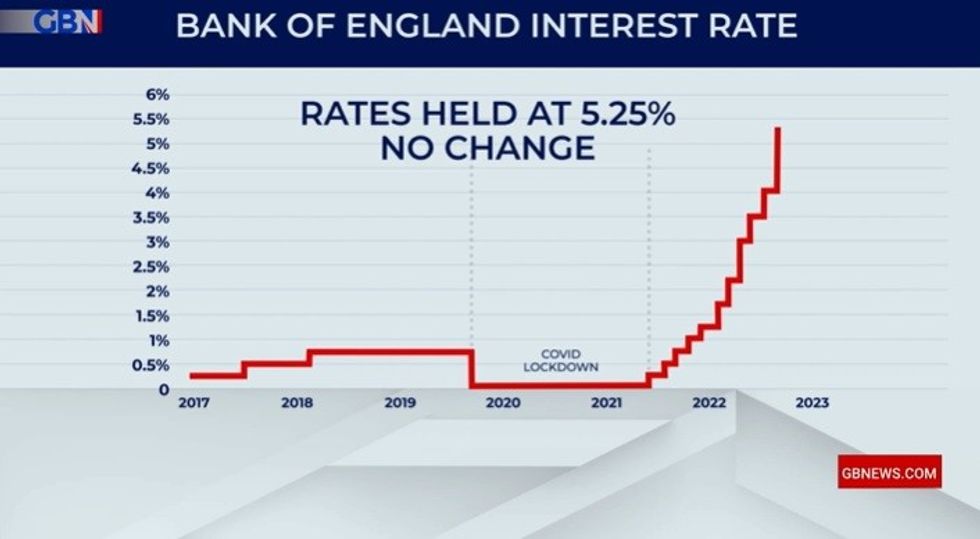

Maitham Mohsin, Head of Savings at Skipton Building Society, said: “After the Bank of England decided to hold its Base Rate last time out, it appears savings rates may have started to level off and in some product areas start to fall.

LATEST DEVELOPMENTS:

- HSBC warns there's just one week left to get 5.7% savings account offer

- Best fixed cash ISAs: Top accounts for tax-free savings paying up to 5.85%

- Best easy access savings accounts right now offering up to 5.2%

“Here at Skipton, we’re trying to buck the trend and are taking the opportunity to increase a couple of our rates today.

‚ÄúBoth of these accounts are fantastic options for savers looking to get their money working through the remainder of this year and into next, particularly if you‚Äôre not looking to totally lock your cash away for a fixed period of time.‚ÄĚ

Savers have been seeing a number of savings providers increase interest rates on savings recently, amid the Bank of England increasing the base rate 14 consecutive times.

However, there's been speculation that fewer savings boosts will be seen after the Bank of England voted to hold the base rate at 5.25 per cent last month.