Bank of England 'under pressure' to slash interest rates next month after shock inflation drop

The Bank of England has been urged to slash interest rates at a faster rate following today's inflation figures from the Office for National Statistics (ONS).UK inflation fell to 2.6 per cent in March, below City forecasts of 2.7 per cent, increasing pressure on the central bank to cut the base rate next month.This drop from February's 2.8 per cent marks the second consecutive monthly decline in the consumer prices index with analysts suggest the Bank's monetary policy committee may now be more likely to reduce its main interest rate from the current 4.5 per cent.The Bank's Monetary Policy Committee (MPC) are next scheduled to meet on May 8, 2025 to discuss the current trajectory of interest rates.ONS data showed the decline was larger than economists had predicted, with lower prices at the pump contributing significantly to the drop.Inflation remains above the Bank of England's two per cent target, but the downward trend has continued since January, when the rate stood at three per cent.The fall in March follows February's cooling of clothing costs, which helped bring the consumer prices index down. However, this drop in inflation is expected to be temporary, with prices set to rise again in April.Households will begin to pay higher council tax and utility bills this month, pushing inflation back above three per cent. Domestic energy bills are also increasing, alongside the potential impact of higher taxes and labour costs for businesses.Companies are likely to pass some of these costs on to customers, further contributing to inflationary pressures. Before recent global developments, analysts had predicted inflation would peak at about four per cent over the summer.Dean Butler, the managing director for Retail Direct at Standard Life, commented: "While the weather's been picking up, inflation has been cooling down, falling to 2.6 per cent in March. "Unfortunately, this might be the last of the good news, as the impact of a tumultuous April kicks in next month." He added that "energy price rises and other bill increases combined with the impact of tariff turmoil all look set to make their mark" on inflation figures.Donald Trump's tariff announcements this month have cast doubt on previous inflation forecasts. The US President's trade policies could depress global growth and prices, potentially leading to a lower peak in inflation than previously anticipated. One impact has been lower oil prices, which will have a downward effect on inflation. There are also concerns that China might dump goods in Europe that were previously destined for the US, further affecting price trends.Former Bank of England deputy governor Charlie Bean said last week that tariff uncertainty meant the Bank should set aside concerns about inflation.LATEST DEVELOPMENTS:Recession fears grow as MPs push to ban money printing amid Donald Trump trade warBank of England issues new update for anyone with a mortgageState pension means testing fears grow as Bank of England blames 'ageing population' for UK economyHe suggested cutting the cost of borrowing by at least half a per cent. Former Prime Minister Gordon Brown has gone further, calling for a coordinated rate cut by all major central banks.Most economists now believe a May rate cut is "increasingly nailed on". The impact of these economic conditions will be mixed for consumers. A rate cut would benefit borrowers and mortgage holders but mean lower returns for savers."Shopping around for the best rates remains crucial in order to avoid losing returns on savings," Butler advised.Butler noted that "pensions remain one of the most tax-efficient ways to save" regardless of market conditions.

The Bank of England has been urged to slash interest rates at a faster rate following today's inflation figures from the Office for National Statistics (ONS).

UK inflation fell to 2.6 per cent in March, below City forecasts of 2.7 per cent, increasing pressure on the central bank to cut the base rate next month.

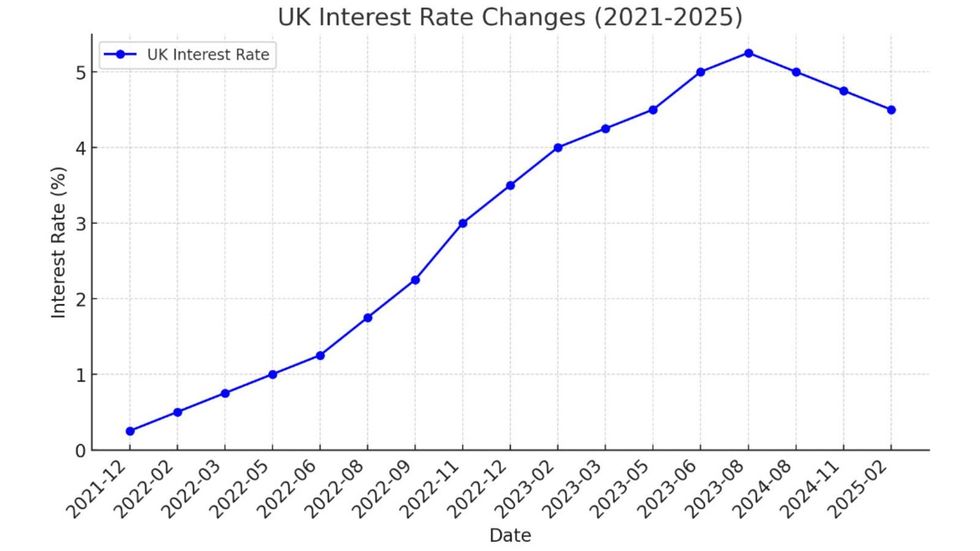

This drop from February's 2.8 per cent marks the second consecutive monthly decline in the consumer prices index with analysts suggest the Bank's monetary policy committee may now be more likely to reduce its main interest rate from the current 4.5 per cent.

The Bank's Monetary Policy Committee (MPC) are next scheduled to meet on May 8, 2025 to discuss the current trajectory of interest rates.

ONS data showed the decline was larger than economists had predicted, with lower prices at the pump contributing significantly to the drop.

Inflation remains above the Bank of England's two per cent target, but the downward trend has continued since January, when the rate stood at three per cent.

The fall in March follows February's cooling of clothing costs, which helped bring the consumer prices index down. However, this drop in inflation is expected to be temporary, with prices set to rise again in April.

Households will begin to pay higher council tax and utility bills this month, pushing inflation back above three per cent. Domestic energy bills are also increasing, alongside the potential impact of higher taxes and labour costs for businesses.

Companies are likely to pass some of these costs on to customers, further contributing to inflationary pressures. Before recent global developments, analysts had predicted inflation would peak at about four per cent over the summer.

Dean Butler, the managing director for Retail Direct at Standard Life, commented: "While the weather's been picking up, inflation has been cooling down, falling to 2.6 per cent in March.

"Unfortunately, this might be the last of the good news, as the impact of a tumultuous April kicks in next month." He added that "energy price rises and other bill increases combined with the impact of tariff turmoil all look set to make their mark" on inflation figures.

Donald Trump's tariff announcements this month have cast doubt on previous inflation forecasts. The US President's trade policies could depress global growth and prices, potentially leading to a lower peak in inflation than previously anticipated.

One impact has been lower oil prices, which will have a downward effect on inflation. There are also concerns that China might dump goods in Europe that were previously destined for the US, further affecting price trends.

Former Bank of England deputy governor Charlie Bean said last week that tariff uncertainty meant the Bank should set aside concerns about inflation.

LATEST DEVELOPMENTS:

- Recession fears grow as MPs push to ban money printing amid Donald Trump trade war

- Bank of England issues new update for anyone with a mortgage

- State pension means testing fears grow as Bank of England blames 'ageing population' for UK economy

He suggested cutting the cost of borrowing by at least half a per cent. Former Prime Minister Gordon Brown has gone further, calling for a coordinated rate cut by all major central banks.

Most economists now believe a May rate cut is "increasingly nailed on". The impact of these economic conditions will be mixed for consumers. A rate cut would benefit borrowers and mortgage holders but mean lower returns for savers.

"Shopping around for the best rates remains crucial in order to avoid losing returns on savings," Butler advised.

Butler noted that "pensions remain one of the most tax-efficient ways to save" regardless of market conditions.