Inheritance tax crackdown on thousands as HMRC launches ‘substantial investigation’ – do you owe money?

HM Revenue and Customs (HMRC) has launched an investigation into thousands of families who may not be paying enough inheritance tax (IHT).More than 2,000 households are reportedly under investigation with many not realising they are liable to pay the tax.According to financial planning firm NFU Mutual, HMRC has opened 2,029 IHT investigations between April and November 2023.The taxman clawed back £172million over the period in underpaid death levies with more money being generated thanks to rising house prices and frozen tax allowances.Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.A sizable proportion of the inheritance tax recovered will come from HMRC investigations opened months and years ago.For the 2023-24 tax year, the Treasury is estimated to raise £7.6billion from IHT which is a £500million rise from 2022-23.As is stands, inheritance tax is charged at 40 per cent on estates which exceed the “nil rate” allowance of £325,000.This threshold is raised to £500,000 if the main home is left to a direct descendant with anything left to a spouse or civil partner being exempt from the levy.In 2022-23, over 3,100 investigations were opened with £251million recovered by HMRC over the period.Inheritance tax bills must be paid within six months of an individual’s death with the tax authority investigating estates if there is a suspicion the levy has been underpaid or avoided.Sean McCann, a chartered financial planner at NFU Mutual, reminded taxpayers of the “substantial powers” the Government has to carry out this crackdown.He explained: “HMRC has substantial investigation powers if it suspects inheritance tax has been underpaid through error, omission or by undervaluing assets. LATEST DEVELOPMENTS:Banks make biggest savings interest cut in decade as customers told to ‘shop around’Asda, John Lewis and Costco shoppers urged to watch out as thousands targeted by convincing scamBlow to Britons as UK inflation to be highest in G7 despite economy revival“It will check other information sources to build up a picture of the deceased and their financial affairs — including bank statements or looking at income which may suggest the existence of undisclosed assets such as investments, property or significant foreign currency transactions.”Under the seven-year rule, households are permitted to make certain gifts from tax as long as they live seven years after making them.If someone dies before the seven years are up, the gifts will be included as part of their estate and IHT charged on a sliding scale if the value is greater than the £325,000 allowance.Similar to its investigations into missing IHT bills, HMRC will also investigate if any suspicious gifts have been made.GB News has contacted HMRC asking for comment.

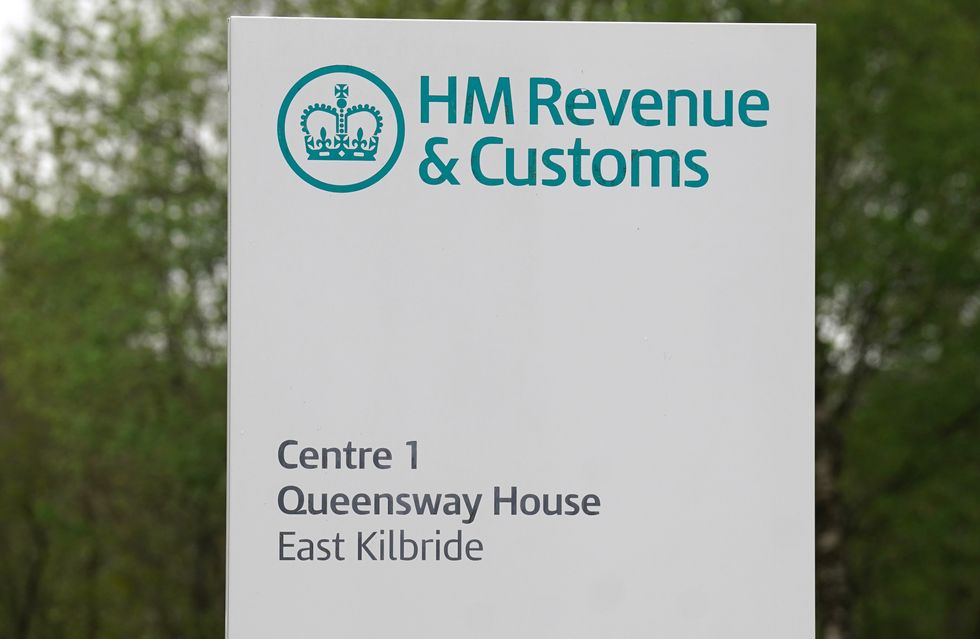

HM Revenue and Customs (HMRC) has launched an investigation into thousands of families who may not be paying enough inheritance tax (IHT).

More than 2,000 households are reportedly under investigation with many not realising they are liable to pay the tax.

According to financial planning firm NFU Mutual, HMRC has opened 2,029 IHT investigations between April and November 2023.

The taxman clawed back £172million over the period in underpaid death levies with more money being generated thanks to rising house prices and frozen tax allowances.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

A sizable proportion of the inheritance tax recovered will come from HMRC investigations opened months and years ago.

For the 2023-24 tax year, the Treasury is estimated to raise £7.6billion from IHT which is a £500million rise from 2022-23.

As is stands, inheritance tax is charged at 40 per cent on estates which exceed the “nil rate” allowance of £325,000.

This threshold is raised to £500,000 if the main home is left to a direct descendant with anything left to a spouse or civil partner being exempt from the levy.

In 2022-23, over 3,100 investigations were opened with £251million recovered by HMRC over the period.

Inheritance tax bills must be paid within six months of an individual’s death with the tax authority investigating estates if there is a suspicion the levy has been underpaid or avoided.

Sean McCann, a chartered financial planner at NFU Mutual, reminded taxpayers of the “substantial powers” the Government has to carry out this crackdown.

He explained: “HMRC has substantial investigation powers if it suspects inheritance tax has been underpaid through error, omission or by undervaluing assets.

LATEST DEVELOPMENTS:

- Banks make biggest savings interest cut in decade as customers told to ‘shop around’

- Asda, John Lewis and Costco shoppers urged to watch out as thousands targeted by convincing scam

- Blow to Britons as UK inflation to be highest in G7 despite economy revival

“It will check other information sources to build up a picture of the deceased and their financial affairs — including bank statements or looking at income which may suggest the existence of undisclosed assets such as investments, property or significant foreign currency transactions.”

Under the seven-year rule, households are permitted to make certain gifts from tax as long as they live seven years after making them.

If someone dies before the seven years are up, the gifts will be included as part of their estate and IHT charged on a sliding scale if the value is greater than the £325,000 allowance.

Similar to its investigations into missing IHT bills, HMRC will also investigate if any suspicious gifts have been made.

GB News has contacted HMRC asking for comment.