2.7 million Britons missing out on getting council tax reduced or for free – are you?

Britons could be entitled to a reduction on their council tax bill and potentially not have to pay anything at all but millions are missing out on this concession.Households could get concessions from 25 per cent or more on the levy, with some able to get it for free.An estimated £2.9billion in council tax support has gone unclaimed by over 2.7 million people, according to research by Policy in Practice.Council tax could rise next year with local authorities in England and Wales able to implement a five per cent hike without calling a referendum, making it even more important for people to look into what they qualify for.Here is a breakdown of who is eligible for a council tax reduction and how much you could be entitled to.What is a council tax reduction?Councils offer this support to households who are struggling financially but how much support is given depends on individual circumstances.Household income, benefit entitlement and how many children someone has could affect their claim for support.Before applying, those looking to get a reduction will need their National Insurance number, bank statements, a passport or driving licence, and a recent payslip or Jobcentre letter.Using the Government’s postcode checker, applicants will be able to search for the contact details of their local council to begin the process.Who is eligible for a council tax reduction?The majority of people deemed as “qualifying adults” have to pay council tax for their property but how much they pay depends on their local area.The following groups are “disregarded” from paying the levy, according to the Government’s website:under 18 years oldon certain apprentice schemes18 or 19 years old and in full-time educationa full-time student at college or universityunder 25 years old and get funding from the Education and Skills Funding Agencya student nursea foreign language assistant registered with the British Councilseverely mentally impaireda live-in carer for someone who is not your partner, spouse, or child under 18a diplomat.Single people of working age may be entitled to a reduction if they are the only person living in the property.Pensioners and those on low income can apply for a council tax reduction but how much they get differs depending on benefit entitlement and income.LATEST DEVELOPMENTS:National Insurance to be cut next week but UK workers still to be 'worse-off or unaffected'HMRC reminds workers how to claim £125 tax refund – are you eligible?Britons could boost their savings pot by £1,400 a year thanks to ‘very simple’ hackHow much is a council tax reduction?If there are two or more qualifying adults in a home, this means that no concession is applied and the household has to pay council tax in full. When there is only one qualifying adult living in the property, this means that they qualify for a single person discount which is 20 per cent off their bill.Households with no qualifying adults will either be awarded a discount worth 50 per cent or a 100 per cent exemption depending on who resides in the property.Pensioners may be entitled to a council tax reduction, with the Guarantee Credit element of Pension Credit ensuring 100 per cent off the bill.If a pensioner lives alone and does not get Pension Credit, they only get a 25 per cent discount.

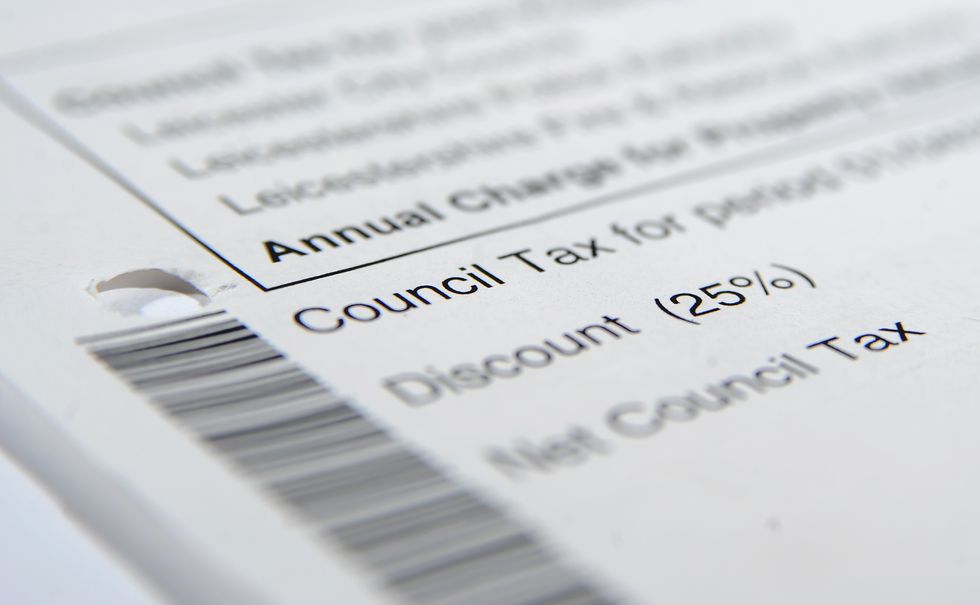

Britons could be entitled to a reduction on their council tax bill and potentially not have to pay anything at all but millions are missing out on this concession.

Households could get concessions from 25 per cent or more on the levy, with some able to get it for free.

An estimated £2.9billion in council tax support has gone unclaimed by over 2.7 million people, according to research by Policy in Practice.

Council tax could rise next year with local authorities in England and Wales able to implement a five per cent hike without calling a referendum, making it even more important for people to look into what they qualify for.

Here is a breakdown of who is eligible for a council tax reduction and how much you could be entitled to.

What is a council tax reduction?

Councils offer this support to households who are struggling financially but how much support is given depends on individual circumstances.

Household income, benefit entitlement and how many children someone has could affect their claim for support.

Before applying, those looking to get a reduction will need their National Insurance number, bank statements, a passport or driving licence, and a recent payslip or Jobcentre letter.

Using the Government’s postcode checker, applicants will be able to search for the contact details of their local council to begin the process.

Who is eligible for a council tax reduction?

The majority of people deemed as “qualifying adults” have to pay council tax for their property but how much they pay depends on their local area.

The following groups are “disregarded” from paying the levy, according to the Government’s website:

- under 18 years old

- on certain apprentice schemes

- 18 or 19 years old and in full-time education

- a full-time student at college or university

- under 25 years old and get funding from the Education and Skills Funding Agency

- a student nurse

- a foreign language assistant registered with the British Council

- severely mentally impaired

- a live-in carer for someone who is not your partner, spouse, or child under 18

- a diplomat.

Single people of working age may be entitled to a reduction if they are the only person living in the property.

Pensioners and those on low income can apply for a council tax reduction but how much they get differs depending on benefit entitlement and income.

LATEST DEVELOPMENTS:

- National Insurance to be cut next week but UK workers still to be 'worse-off or unaffected'

- HMRC reminds workers how to claim £125 tax refund – are you eligible?

- Britons could boost their savings pot by £1,400 a year thanks to ‘very simple’ hack

How much is a council tax reduction?

If there are two or more qualifying adults in a home, this means that no concession is applied and the household has to pay council tax in full. When there is only one qualifying adult living in the property, this means that they qualify for a single person discount which is 20 per cent off their bill.

Households with no qualifying adults will either be awarded a discount worth 50 per cent or a 100 per cent exemption depending on who resides in the property.

Pensioners may be entitled to a council tax reduction, with the Guarantee Credit element of Pension Credit ensuring 100 per cent off the bill.

If a pensioner lives alone and does not get Pension Credit, they only get a 25 per cent discount.