Best fixed cash ISAs: The top accounts for tax-free savings paying up to 5.85 per cent

Interest rates on savings accounts have been rising in the wake of 14 consecutive Bank of England base rate hikes, meaning savers can get better returns on their cash savings.The extra interest being earned does mean some people are more likely to breach the personal savings allowance, however, meaning some may opt to put their money in an Individual Savings Account (ISA).It’s estimated more than 2.7 million individuals will pay tax on cash interest in the 2023//24 tax year, up by a million in a single year.Laura Suter, head of personal finance at AJ Bell, said: “The combination of higher interest rates and people having shunned ISA accounts in recent years means that the number paying tax on their savings has more than tripled in the past four years.“Rising rates and a frozen personal savings allowance means some individuals are being taxed despite having relatively modest pots of cash set aside for a rainy day.“To add insult to injury, because inflation is so high, they aren’t even making a real return on their money – yet they are still being taxed.”There are four types of ISA, and it’s only possible to pay into one of each of them each year. The types of ISA are a cash ISA, a lifetime ISA (which has a limit of £4,000 per tax year), an innovative finance ISA and a stocks and shares ISA.The annual ISA limit is £20,000 per tax year, and this limit applies across all types of ISAs.ISA eligibility rules vary depending on the type of ISA, but for a cash ISA, a person needs to be aged 16 or over.GB News has compiled a list of the highest paying fixed rate cash ISAs available right now, based on data from money comparison website Moneyfactscompare.co.uk.With all of these accounts, it's important savers check the eligibility criteria and terms as some rules, such as deposit limits, won't be right for everyone.Virgin Money currently comes out top with its one-year fixed rate Cash ISA Exclusive Issue Six, which currently pays 5.85 per cent AER. Its term ends on September 30, 2024. Secure Trust Bank places second with its one-year fixed rate Cash ISA (11.Nov.24) paying 5.75 per cent AER. This term ends on November 11, 2024.This account has a minimum operating balance of £1,000, and the minimum for each deposit is £1,000.Virgin Money is also third in the current list of best Cash ISA interest rates, this time with the one-year fixed rate Cash E-ISA Issue 619, paying 5.75 per cent.LATEST DEVELOPMENTS:Top regular savings accounts paying up to eight per cent right nowBest easy access savings accounts right now offering up to 5.2%Savers told to ‘move quickly’ to lock in top interest ratesBest interest rates on fixed cash ISAsVirgin Money 1 Year Fixed Rate Cash ISA Exclusive Issue 6 – 5/85 per centSecure Trust Bank 1 Year Fixed Rate Cash ISA (11.Nov.24) – 5.75 per centVirgin Money 1 Year Fixed Rate Cash E-ISA Issue 619 – 5.75 per centKent Reliance Cash ISA 1 Year Fixed Rate - Issue 81 – 5.71 per centSainsbury's Bank Fixed Rate Cash ISA – 5.70 per centUBL UK 1 Year Fixed Rate Cash ISA – 5.70 per centUnited Trust Bank Cash ISA 1 Year Bond – 5.70 per centHodge Bank 1 Year Fixed Rate Cash ISA – 5.67 per centClose Brothers Savings 1 Year Fixed Rate Cash ISA – 5.65 per centMarsden BS Fixed Rate Cash ISA (Issue 178) – 5.65 per centNatWest 1 Year Fixed Rate ISA Issue 332 – 5.65 per centNatWest 2 Year Fixed Rate ISA Issue 333 – 5.65 per centOakNorth Bank Fixed Rate Cash ISA – 5.65 per centRoyal Bank of Scotland 1 Year Fixed Rate ISA Issue 332 - 5.65 per centRoyal Bank of Scotland 2 Year Fixed Rate ISA Issue 333 – 5.65 per cent

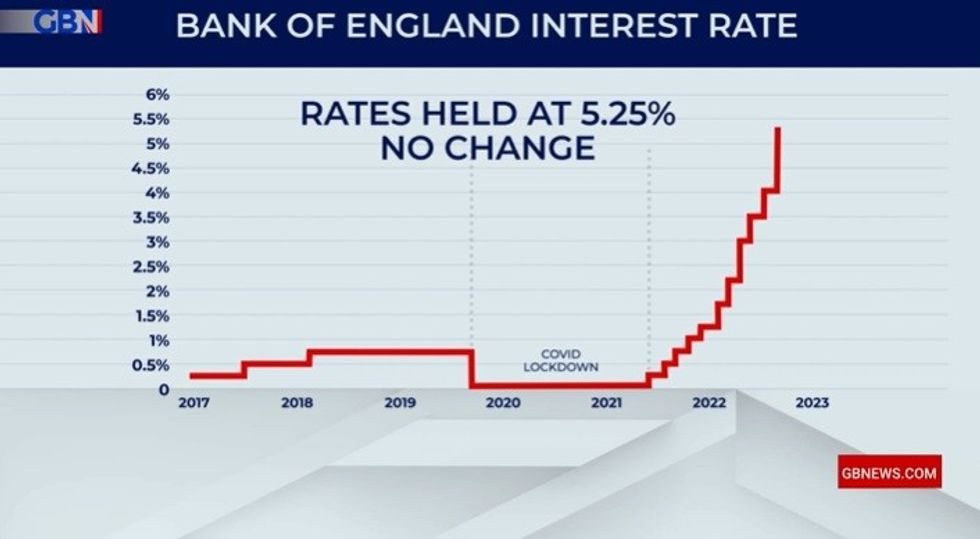

Interest rates on savings accounts have been rising in the wake of 14 consecutive Bank of England base rate hikes, meaning savers can get better returns on their cash savings.

The extra interest being earned does mean some people are more likely to breach the personal savings allowance, however, meaning some may opt to put their money in an Individual Savings Account (ISA).

It’s estimated more than 2.7 million individuals will pay tax on cash interest in the 2023//24 tax year, up by a million in a single year.

Laura Suter, head of personal finance at AJ Bell, said: “The combination of higher interest rates and people having shunned ISA accounts in recent years means that the number paying tax on their savings has more than tripled in the past four years.

“Rising rates and a frozen personal savings allowance means some individuals are being taxed despite having relatively modest pots of cash set aside for a rainy day.

“To add insult to injury, because inflation is so high, they aren’t even making a real return on their money – yet they are still being taxed.”

There are four types of ISA, and it’s only possible to pay into one of each of them each year. The types of ISA are a cash ISA, a lifetime ISA (which has a limit of £4,000 per tax year), an innovative finance ISA and a stocks and shares ISA.

The annual ISA limit is £20,000 per tax year, and this limit applies across all types of ISAs.

ISA eligibility rules vary depending on the type of ISA, but for a cash ISA, a person needs to be aged 16 or over.

GB News has compiled a list of the highest paying fixed rate cash ISAs available right now, based on data from money comparison website Moneyfactscompare.co.uk.

With all of these accounts, it's important savers check the eligibility criteria and terms as some rules, such as deposit limits, won't be right for everyone.

Virgin Money currently comes out top with its one-year fixed rate Cash ISA Exclusive Issue Six, which currently pays 5.85 per cent AER. Its term ends on September 30, 2024.

Secure Trust Bank places second with its one-year fixed rate Cash ISA (11.Nov.24) paying 5.75 per cent AER. This term ends on November 11, 2024.

This account has a minimum operating balance of £1,000, and the minimum for each deposit is £1,000.

Virgin Money is also third in the current list of best Cash ISA interest rates, this time with the one-year fixed rate Cash E-ISA Issue 619, paying 5.75 per cent.

LATEST DEVELOPMENTS:

- Top regular savings accounts paying up to eight per cent right now

- Best easy access savings accounts right now offering up to 5.2%

- Savers told to ‘move quickly’ to lock in top interest rates

Best interest rates on fixed cash ISAs

- Virgin Money 1 Year Fixed Rate Cash ISA Exclusive Issue 6 – 5/85 per cent

- Secure Trust Bank 1 Year Fixed Rate Cash ISA (11.Nov.24) – 5.75 per cent

- Virgin Money 1 Year Fixed Rate Cash E-ISA Issue 619 – 5.75 per cent

- Kent Reliance Cash ISA 1 Year Fixed Rate - Issue 81 – 5.71 per cent

- Sainsbury's Bank Fixed Rate Cash ISA – 5.70 per cent

- UBL UK 1 Year Fixed Rate Cash ISA – 5.70 per cent

- United Trust Bank Cash ISA 1 Year Bond – 5.70 per cent

- Hodge Bank 1 Year Fixed Rate Cash ISA – 5.67 per cent

- Close Brothers Savings 1 Year Fixed Rate Cash ISA – 5.65 per cent

- Marsden BS Fixed Rate Cash ISA (Issue 178) – 5.65 per cent

- NatWest 1 Year Fixed Rate ISA Issue 332 – 5.65 per cent

- NatWest 2 Year Fixed Rate ISA Issue 333 – 5.65 per cent

- OakNorth Bank Fixed Rate Cash ISA – 5.65 per cent

- Royal Bank of Scotland 1 Year Fixed Rate ISA Issue 332 - 5.65 per cent

- Royal Bank of Scotland 2 Year Fixed Rate ISA Issue 333 – 5.65 per cent