Full list of best savings accounts of the week: Interest rates hit 5.22 percent

Experts are sharing the best savings account interest rates currently on offer ahead of the New Year.Moneyfactscompare broke down this week’s top easy access savings rates with products offering 5.22 percent.Easy access products are savings accounts which offer people the opportunity to withdraw and deposit their cash with ease.Thanks to the Bank of England’s series of base rate hikes, easy access accounts are providing bank customers with competitive rates.According to Moneyfactscompare, the following banks currently have the best easy access savings accounts:Metro Bank: Savings Account: Instant Access Savings Account Notice Period : None Interest Rate: 5.22 percent AER (includes a bonus).Ulster Bank Savings Account: Loyalty Saver Notice Period: None Interest Rate: 5.20 percent AEREarl Shilton Building Society Savings Account: Bonus One Account Notice Period: None Interest Rate: 5.15 percent AER.James Hyde, spokesperson for Moneyfactscompare, highlighted Metro Bank’s “market-leading rate” includes a 3.4 percent bonus for the first 12 months, which comes into effect if a balance of £500 is reached within 28 days of account opening. Mr Hyde shared: “Ulster Bank continues to pay 5.20 percent AER on balances of £5,000 or more on its Loyalty Saver account. LATEST DEVELOPMENTS:Best fixed rate bonds: Savers could earn 5.50% if they lock cash awaySavers could ‘get around three times more’ in interest by switching bank accountsHeat pumps could slash energy bills by up to 60 percent“Deposits below this threshold will receive a lower rate of 2.25 percent AER. The account can be opened and managed online, over the phone or by mobile app. There are no withdrawal limits to consider.“Continuing to sit in third place is Earl Shilton BS, whose Bonus One Account pays 5.15% AER. The account requires a deposit of at least £5,000, and can be opened and managed in branch or by post. “Further additions are permitted without limitation, but making more than one withdrawal in a year will lead to a lower rate of 2.10 percent AER being paid.”

Experts are sharing the best savings account interest rates currently on offer ahead of the New Year.

Moneyfactscompare broke down this week’s top easy access savings rates with products offering 5.22 percent.

Easy access products are savings accounts which offer people the opportunity to withdraw and deposit their cash with ease.

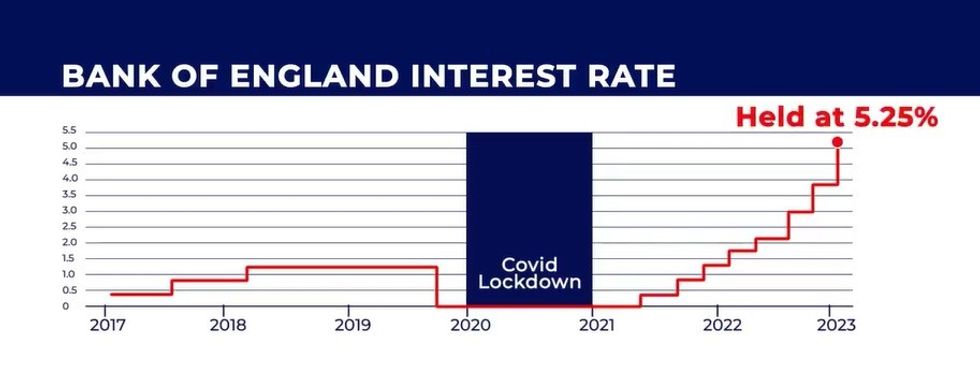

Thanks to the Bank of England’s series of base rate hikes, easy access accounts are providing bank customers with competitive rates.

According to Moneyfactscompare, the following banks currently have the best easy access savings accounts:

Metro Bank:

- Savings Account: Instant Access Savings Account

- Notice Period : None

- Interest Rate: 5.22 percent AER (includes a bonus).

Ulster Bank

- Savings Account: Loyalty Saver

- Notice Period: None

- Interest Rate: 5.20 percent AER

Earl Shilton Building Society

- Savings Account: Bonus One Account

- Notice Period: None

- Interest Rate: 5.15 percent AER.

James Hyde, spokesperson for Moneyfactscompare, highlighted Metro Bank’s “market-leading rate” includes a 3.4 percent bonus for the first 12 months, which comes into effect if a balance of £500 is reached within 28 days of account opening.

Mr Hyde shared: “Ulster Bank continues to pay 5.20 percent AER on balances of £5,000 or more on its Loyalty Saver account.

LATEST DEVELOPMENTS:

- Best fixed rate bonds: Savers could earn 5.50% if they lock cash away

- Savers could ‘get around three times more’ in interest by switching bank accounts

- Heat pumps could slash energy bills by up to 60 percent

“Deposits below this threshold will receive a lower rate of 2.25 percent AER. The account can be opened and managed online, over the phone or by mobile app. There are no withdrawal limits to consider.

“Continuing to sit in third place is Earl Shilton BS, whose Bonus One Account pays 5.15% AER. The account requires a deposit of at least £5,000, and can be opened and managed in branch or by post.

“Further additions are permitted without limitation, but making more than one withdrawal in a year will lead to a lower rate of 2.10 percent AER being paid.”