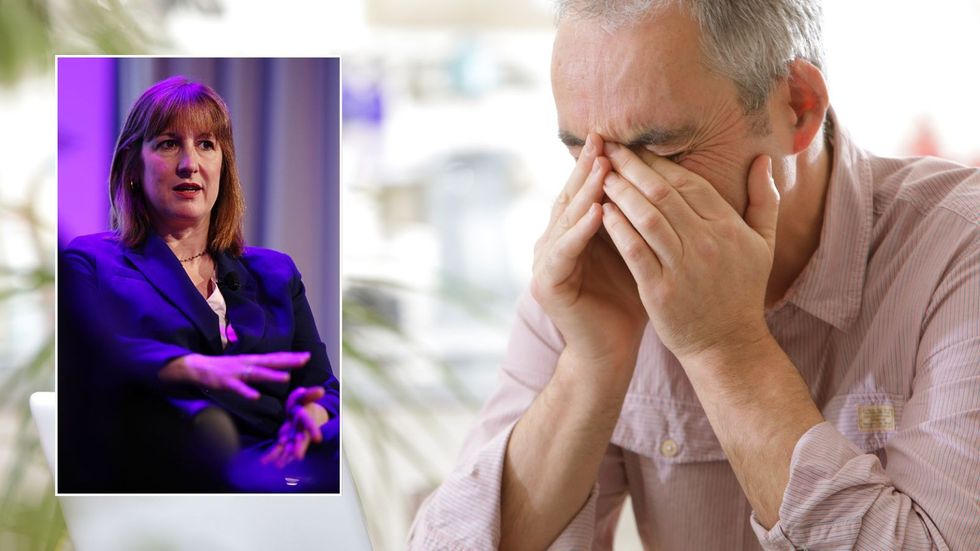

Britons face £30bn tax raid from Rachel Reeves to pay for 'dramatic increase' in Nato defence spending

Britons are in line for a tax raid of up to £30billion in the Autumn Budget to fund enhanced defence spending, economists have cautioned. Analysts suggest higher taxes appear unavoidable as Chancellor Rachel Reeves would otherwise find it difficult to fulfil commitments to boost defence expenditure whilst adhering to her self-imposed fiscal rules.Prime Minister Keir Starmer has committed to raising UK defence spending to 3 per cent of GDP by the next parliament but NATO is anticipated to require even greater commitments later this year.Reeves may need to abandon manifesto pledges not to raise income tax, National Insurance or VAT as spending pressures mount. NATO is expected to demand members increase defence spending to 3.5 per cent of GDP in the coming years.Mark Rutte, the NATO secretary general, recently stated: "We know that the two per cent pledge agreed way back in 2014 just doesn't cut it any more. "So in 2025, we are finalising a plan to dramatically increase defence spending across the Alliance."The additional defence spending requirements come as Reeves faces pressure following the recent reversal on Winter Fuel Payments for pensioners and unfavourable movements in financial markets.Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.Michael Saunders, a senior policy advisor at consultancy Oxford Economics, said the Prime Minister was likely to increase spending gradually over this parliament to make the three per cent target and above easier to achieve in future.Saunders said: "To establish a more credible path to defence spending 'considerably north of three per cent' next decade, the Government may decide in the Autumn Budget that it needs to add some extra spending within the five-year OBR forecast horizon."It's not hard to see pressures for extra fiscal tightening of £15billion to £30billion. The need to raise revenues may require the Government to revisit its manifesto commitments, which seemed to rule out increases in most major taxes."The Chancellor has left herself a margin of just £9.9billion to meet her fiscal rules, a wafer-thin buffer that forced her to tear up spending plans in the spring to repair her budget. LATEST DEVELOPMENTS:HMRC urges households to apply for £4,000 a year savings 'boost' thanks to tax-free schemeElon Musk net worth plummets $34bn in a day as Trump feud sparks Tesla sell offRachel Reeves refuses to rule out tax rises in Autumn Budget as Treasury faces £24bn shortfallAnalysts note Reeves must also contend with mounting costs from the Labour Government's pledge to restore winter fuel payments and review the two-child benefit cap.There are concerns that a downgrade to the UK's economic growth by the OBR and increased Government borrowing costs from rising gilt yields could eliminate Reeves's limited fiscal headroom entirely.Earlier this week, the Chancellor repeatedly refused to rule out further tax rises. "I'm not going to say that I'm not going to take any tax measures in the next four years," she told business leaders at the Confederation of British Industry annual dinner.

Britons are in line for a tax raid of up to £30billion in the Autumn Budget to fund enhanced defence spending, economists have cautioned.

Analysts suggest higher taxes appear unavoidable as Chancellor Rachel Reeves would otherwise find it difficult to fulfil commitments to boost defence expenditure whilst adhering to her self-imposed fiscal rules.

Prime Minister Keir Starmer has committed to raising UK defence spending to 3 per cent of GDP by the next parliament but NATO is anticipated to require even greater commitments later this year.

Reeves may need to abandon manifesto pledges not to raise income tax, National Insurance or VAT as spending pressures mount.

NATO is expected to demand members increase defence spending to 3.5 per cent of GDP in the coming years.

Mark Rutte, the NATO secretary general, recently stated: "We know that the two per cent pledge agreed way back in 2014 just doesn't cut it any more.

"So in 2025, we are finalising a plan to dramatically increase defence spending across the Alliance."

The additional defence spending requirements come as Reeves faces pressure following the recent reversal on Winter Fuel Payments for pensioners and unfavourable movements in financial markets.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Michael Saunders, a senior policy advisor at consultancy Oxford Economics, said the Prime Minister was likely to increase spending gradually over this parliament to make the three per cent target and above easier to achieve in future.

Saunders said: "To establish a more credible path to defence spending 'considerably north of three per cent' next decade, the Government may decide in the Autumn Budget that it needs to add some extra spending within the five-year OBR forecast horizon.

"It's not hard to see pressures for extra fiscal tightening of £15billion to £30billion. The need to raise revenues may require the Government to revisit its manifesto commitments, which seemed to rule out increases in most major taxes."

The Chancellor has left herself a margin of just £9.9billion to meet her fiscal rules, a wafer-thin buffer that forced her to tear up spending plans in the spring to repair her budget.

LATEST DEVELOPMENTS:

- HMRC urges households to apply for £4,000 a year savings 'boost' thanks to tax-free scheme

- Elon Musk net worth plummets $34bn in a day as Trump feud sparks Tesla sell off

- Rachel Reeves refuses to rule out tax rises in Autumn Budget as Treasury faces £24bn shortfall

Analysts note Reeves must also contend with mounting costs from the Labour Government's pledge to restore winter fuel payments and review the two-child benefit cap.

There are concerns that a downgrade to the UK's economic growth by the OBR and increased Government borrowing costs from rising gilt yields could eliminate Reeves's limited fiscal headroom entirely.

Earlier this week, the Chancellor repeatedly refused to rule out further tax rises.

"I'm not going to say that I'm not going to take any tax measures in the next four years," she told business leaders at the Confederation of British Industry annual dinner.